WA faces health coverage issues if enhanced Premium Tax Credit lapses

OLYMPIA — Washingtonians could face a significant increase in their health insurance premiums as the Enhanced Premium Tax Credit, ePTC, is set to expire at the end of 2025, unless action is taken by Congress. The issue is a significant talking point for both parties as the federal government shutdown continues.

The Affordable Care Act’s ePTC helped around 216,000 Washingtonians by decreasing enrollees’ average annual premium costs, according to Washington State Insurance Commissioner Patty Kuderer. The credits helped decrease average annual premium costs by around $1,300 per person.

“Another year of increased premiums will be hard to hear for the thousands of Washingtonians who buy their own health coverage,” Insurance Commissioner Patty Kuderer said.

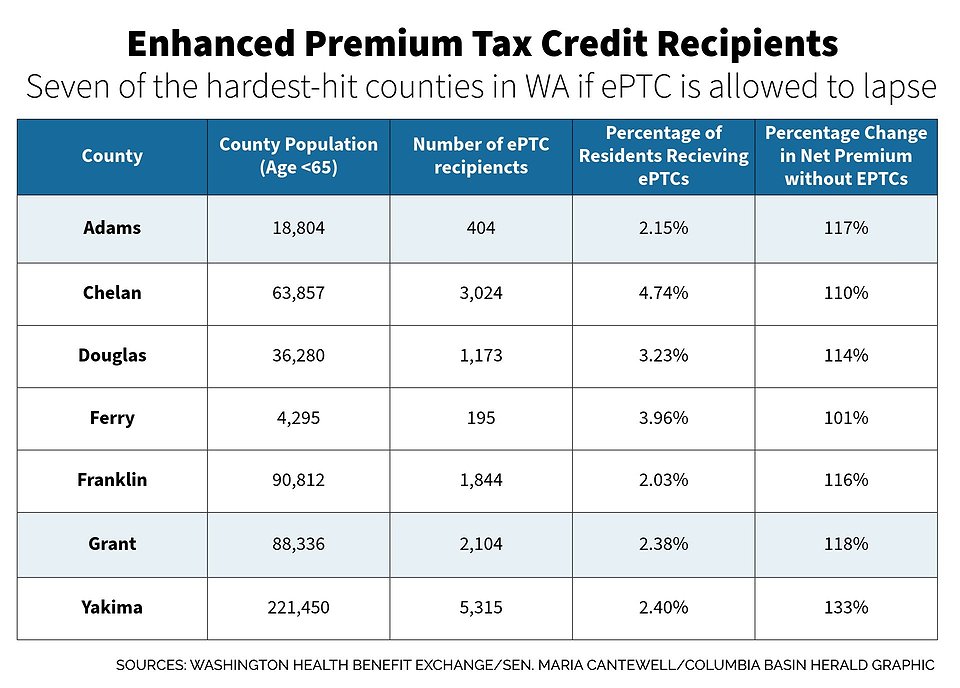

In a report detailing the situation, Cantwell highlighted that in seven counties — predominantly rural counties east of the Cascades, including Yakima, Grant and Adams — average health insurance premiums are expected to more than double.

According to a presentation from the Washington Health Plan Finder and Washington Health Benefit Exchange, if ePTC expires, there will be large impacts in Washington. They anticipate an enrollment reduction of around 80,000 people, net premium increases of nearly 65% and a loss of nearly $285 million in federal funds.

With the expiration of these enhanced benefits, many residents are bracing for what Senator Maria Cantwell describes as “sticker shock” when the window for open enrollment opens Nov. 1. However, Cantwell said the Washington Healthplanfinder will be updating premium rates available to the public before the start of the open enrollment period.

“The window-shopping period for purchasing health insurance on Washington Healthplanfinder is beginning, and unfortunately, Washingtonians are going to see skyrocketing premiums statewide. They face an impossible choice: Pay hundreds or even thousands of dollars more next year for the exact same plan, downgrade their coverage, or forego health insurance altogether,” Cantwell said in a statement.

Kuderer acknowledged the pains many will feel as a result of potential premium increases.

“When the insurers prove they need a rate change, we’re required by state law to accept it. And this year, insurers pointed to ongoing uncertainty coming from the federal government and the surging costs of health care,” Kuderer said, emphasizing the delicate balance her office must strike when assessing insurers' rate requests.

This year, insurers requested an average rate change of 21.2%, with a 21% increase deemed actuarially justified. Factors that went into the rate change were uncertainty about the ePTC, rising health care costs, rising prescription drug costs, increases in the number of people using services, hospital consolidation and higher rates paid to health care facilities and providers.

Statistics from the Office of the Insurance Commissioner show that approximately 300,000 Washingtonians participated in the individual health insurance market through the Washington Health Benefit Exchange last year, with 75% qualifying for ePTC assistance.

“Without the extension of the Enhanced Premium Tax Credits, we can anticipate a wave of disenrollment, which may leave up to 80,000 people without coverage,” Kuderer said.

This concern anticipates rising premiums leading to fewer younger and healthier individuals participating in the system, contributing to a cycle that burdens consumers further, Kuderer said.

"This cycle is hard for the system to bear and even harder for consumers to endure,” she said.

Cantwell echoed Kuderer's concerns, pointing out that families in Washington are still grappling with inflation affecting everyday expenses like groceries and housing.

“Families are still reeling from sky-high inflation on everyday expenses like electricity, housing, and groceries,” Cantwell said. “Congress must act immediately to extend the expiring Affordable Care Act tax credits or healthcare will be added to their list of financial burdens.”

If the ePTC lapses, families will be disadvantaged, particularly rural communities, which are projected to be the hardest hit.

“Our congressional delegates are committed to fighting for Washingtonians’ health insurance,” Kuderer said.

According to a Frequently Asked Questions published by Congress, without an extension, an estimated 2.2 million Americans could lose health care coverage in 2026, with additional losses in the following years.

The fate of the enhanced credits is tied closely to ongoing political negotiations in Congress. While the ePTC has been extended in previous financial relief packages, the current political landscape raises questions about future legislative action. Kuderer has urged bipartisan efforts to ensure coverage remains affordable.

"We cannot afford to wait,” she said.