Ephrata SD running replacement levy

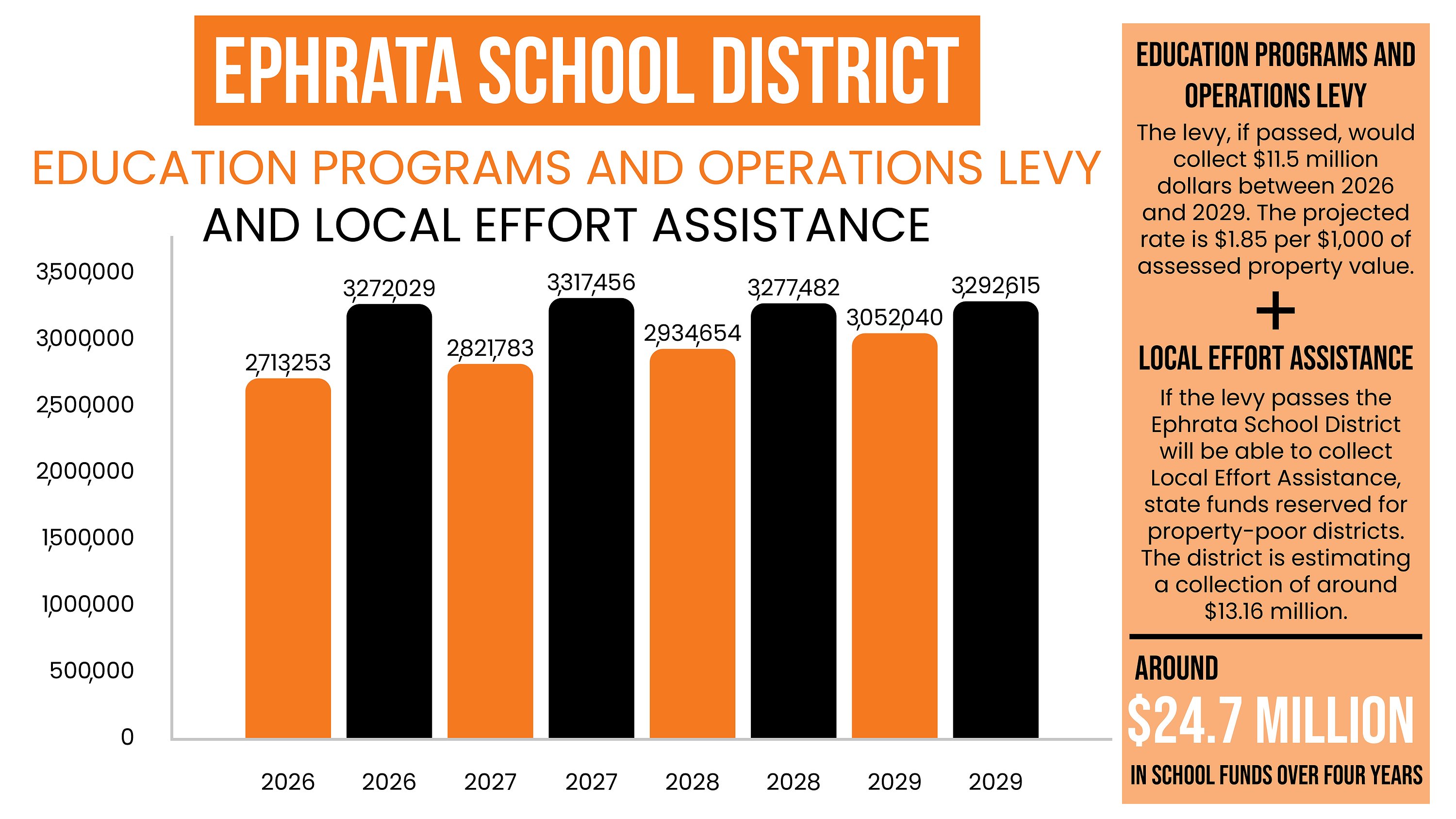

EPHRATA – The Ephrata School District will have an Education Programs and Operations Levy on the ballot Feb. 11. The proposed levy would collect approximately $11.5 million over a four-year period, with a requested tax rate of $1.85 per $1,000 of assessed property value.

The district will host two upcoming events regarding the levy: a formal presentation at the Ephrata High School Performing Arts Center on the evening of Jan. 15 and an informal meet-and-greet at the Bookery on Jan. 22 from 8 a.m. to 11 a.m.

"These sessions are an opportunity for parents and community members to ask questions and gain a clearer understanding of what the funds will be used for," Ephrata Superintendent Ken Murray said.

According to Murray, this is not a new tax; it is replacing the 2021 voter-approved levy. Levy dollars are used to fill in the gap between the funds given by the state and the actual cost to run a school district.

“I think it gives every child the ability to connect in different ways,” Ephrata School District Director of Communications Sarah Morford said. “(Activities and athletics provide) opportunities for them to participate in school outside of the classroom and learn in different ways, and then it allows us to continue to offer the type of education that our community expects.”

Funding

Another reason the levy is important for the district is local effort assistance money. Ephrata has been identified as "property poor" and relies on local effort assistance from the state to enhance its funding alongside its levy money, according to Murray.

"When voters approve a levy in the range of $1.50 to $2.50 per $1,000, it allows us to access state funds," Murray said. "In our case, this levy aims to provide us with access to over $13 million in state funds, contingent upon local approval."

Murray detailed the importance of the proposed levy, explaining that it is crucial for continued support of the district's 2,800 students. Between the EP&O levy and LEA funds the district will receive around $24.7 million.

"This levy is critical to maintaining certain programs and services that support our students," Murray said.

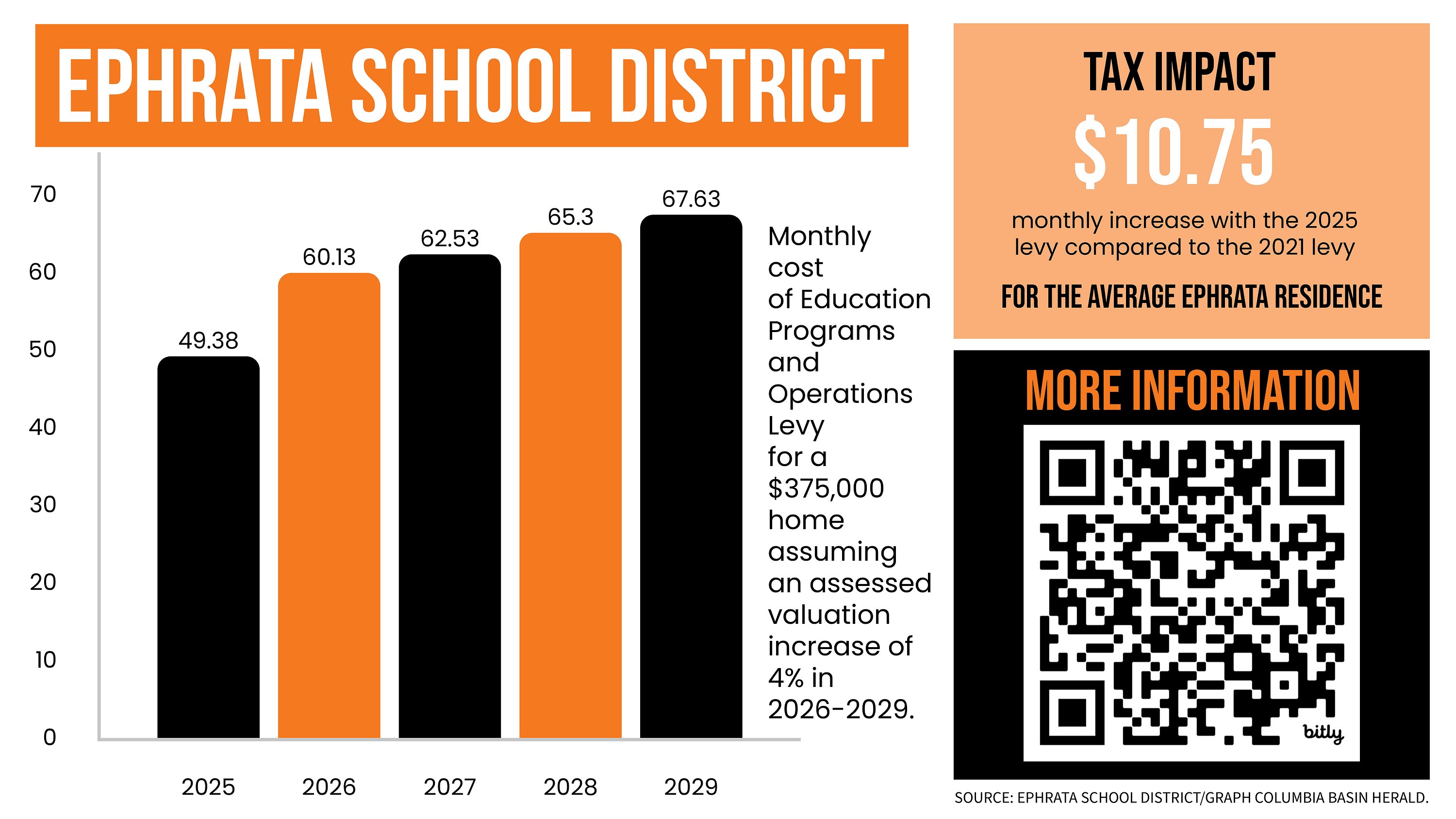

The proposed rate of $1.85 per $1,000 of assessed property value is a modest increase from the previous levy, which was approved at $2.03 but resulted in taxpayers paying an effective rate of $1.58 due to increased property valuations.

For a $375,000 home at a levy rate of $1.58 per $1,000 of assessed property value, a homeowner will expect to pay $60.13 per month in 2024. The number will increase slightly in the next three years to $62.53, $65.03 and $67.63 respectively, according to a presentation from the Ephrata School District. This will be around a $10.75 difference from the 2021 levy.

Levy allocation

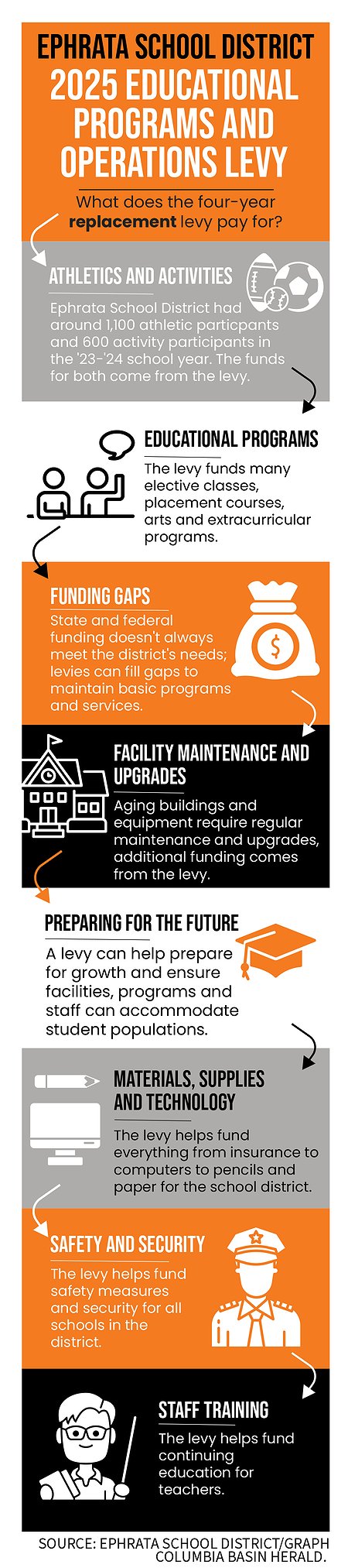

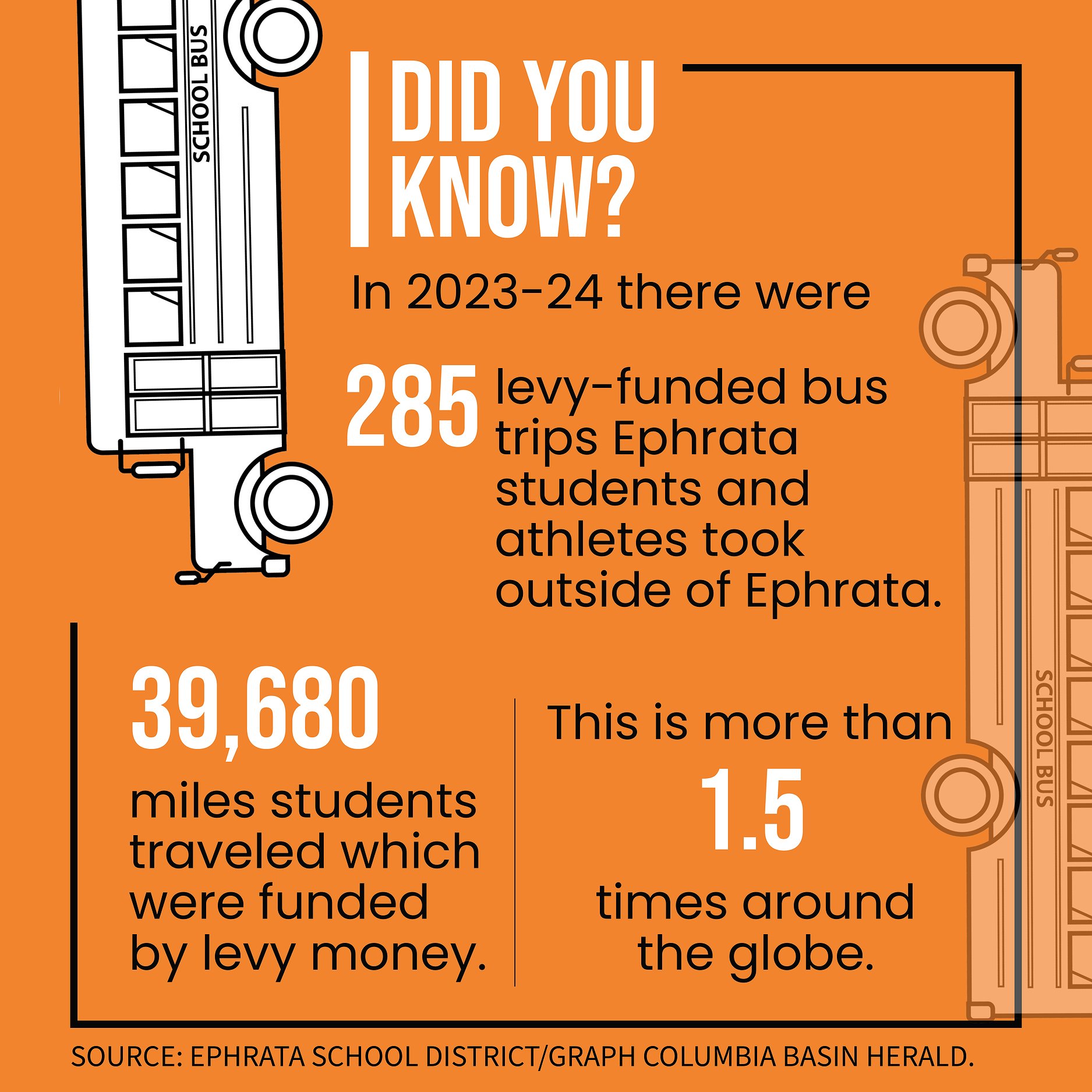

If the levy passes, the funds will be allocated to several key areas including athletic and extracurricular activities, educational programs, funding gaps, facility maintenance and upgrades, preparing for the future, materials, supplies and technology, safety and security and staff training.

"This levy is not about expanding what Ephrata does; it is about maintaining what we currently have," Murray said. "We believe everything we offer adds value to the educational experience."

One pressing issue Murray addressed was the ongoing increase in unfunded materials, supplies, and operating costs. Six years ago, this figure stood at approximately $800,000; however, it has now surged to $2.8 million. The proposed levy funds would help bridge this gap, ensuring that students and staff continue to have the resources they need, according to Murray.

"We recognize that although we're asking for the lowest amount that we requested last time, the actual impact to ratepayers has increased," Morford said.

The Ephrata School District budget is 10% funded by levy dollars. See the graphics for more information on each type of allocation of the funds.

If it fails

The failure of the levy could have significant implications for the district.

"While it is not something I want to dwell on, if we do cross that bridge, we will work collaboratively with stakeholders to determine the most fiscally responsible approach," Murray said.

However, he refrained from detailing specific programs that may face cuts, emphasizing that such determinations would occur only if the situation arises. If the levy fails, both Morford and Murray emphasized the potential consequences on educational programs.

"We recognize that our community has historically supported the schools, and we are hopeful for their continued commitment,” Morford said.

Including the community

School officials are urging community members to engage with information resources. The Ephrata School District has a webpage, TigersVote.org, which is updated with answers to frequently asked questions and has resources explaining the 2025 EP&O levy.

"We want to ensure that everyone is informed and understands the importance of this levy for our schools and our community," Morford said.

With the deadline for ballots approaching, the Ephrata School District emphasized school officials believe that the proposed levy is important for maintaining quality education for the district's approximately 2,800 students.

Moreover, both Murray and Morford said they recognize the challenges of securing community support amid a climate of misinformation.

"We've had constructive dialogue and feedback from staff and community members, indicating a desire to be informed," Morford said. "We have set up an FAQ section on our informational website, TigersVote.org, to address common questions and misconceptions surrounding the levy."

Among the common misconceptions is confusion over the differences between a bond and a levy – a bond is used to build or renovate schools, while a levy is used to fund educational programs and operations – well as eligibility for tax exemptions for seniors and disabled individuals.

"It's crucial for voters to understand that senior citizens and low-income disabled adults have avenues to potentially receive tax relief related to this levy," Morford said.

For those wondering if they qualify for the tax exemption contact the Grant County Assessor’s Office at 509-754-2011.

Financial transparency

Murray clarified that the district is pursuing transparency concerning its financial needs, emphasizing their history of effective fund management.

"We have a long track record of doing what we say we're going to do," he said. "We want our taxpayers to feel secure that their contributions are being used effectively."

The Ephrata School District will have an Education Programs and Operations Levy up for vote in a special election Feb. 11. The levy helps fund athletics and extracurricular activities. The Ephrata High School Future Business Leaders of America chapter went to Orlando, Florida for national competitions in 2024. The EP&O levy helps fund trips such as these.

The Ephrata School District will have an Education Programs and Operations Levy up for vote in a special election Feb. 11. The levy helps fund athletics and extracurricular activities. The Ephrata High School Future Business Leaders of America chapter went to Orlando, Florida for national competitions in 2024. The EP&O levy helps fund trips such as these.FILE PHOTO

This February, the Ephrata School District will have an Education Programs and Operations levy on the ballot. The levy helps the district pay for a variety of things including athletics and extracurricular activities. If the levy passes, the district will receive around $24.7 from both the levy and local effort assistance, state funding for districts with relatively lower property values.

This February, the Ephrata School District will have an Education Programs and Operations levy on the ballot. The levy helps the district pay for a variety of things including athletics and extracurricular activities. If the levy passes, the district will receive around $24.7 from both the levy and local effort assistance, state funding for districts with relatively lower property values.FILE PHOTO