Interest rates down, active listings up in Basin

MOSES LAKE — With lower mortgage rates, listings are up from a year ago in the Basin, as well as statewide, but closed sales are still staying put, according to data released Sept. 6 by the Northwest Multiple Listing Service, which tracks real estate trends in 26 of Washington’s 39 counties.

The average rate on a 30-year mortgage was 6.35% at the end of August, the lowest since March, according to NMLS statistics.

Active listings were up 28.7% in Grant County and 27.5% in Adams County in August 2024 compared to August 2023, according to the NMLS. The increase statewide was 34%. The two counties with the greatest increase were Ferry at 83.3% and Douglas at 45.5%.

Pending sales were up 4.7% statewide, but down slightly locally, from 98 last August in Grant County to 95, and from 9 to 8 in Adams County. Sold listings remained virtually unchanged across the board, at 6,727 in August 2024 compared to 6,734 in August 2023. Grant County went from 81 closed sales to 87, while Adams County went from 13 to 14.

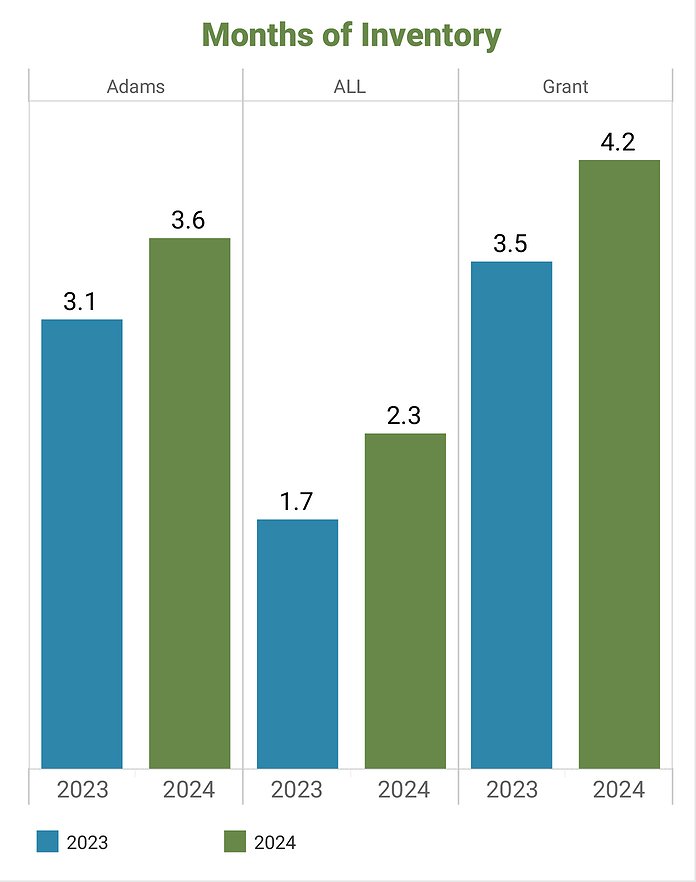

The Columbia Basin fared rather better than the state as a whole when it came to months of inventory, or the amount of time it would take to sell all the homes listed in a particular market. Adams County showed 3.6 MOI in August 2024 and Grant County showed 4.2, while statewide MOI was 2.3, still an increase from the 1.7 of a year ago. The counties with the lowest MOI were all in the Puget Sound area, the lowest being Snohomish County with 1.41 months of inventory.

Median home prices rose somewhat across the state from this time last year, up 4.9% from $615,000 to 645,000. Grant and Adams Counties had much less expensive housing, with the median sale price in Adams County at $307,475 and in Grant County at $350,000.

“Mortgage interest rates have already started to moderate, dropping to 6.35% (for 30-year terms) at the end of August from this year’s high of 7.22% at the beginning of May,” Steven Bourassa, director of the Washington Center for Real Estate Research at the University of Washington, wrote for the NMLS. “Unfortunately, lack of supply is going to continue to be an issue affecting house prices. Single- and multi-family permitting dropped off noticeably in 2022 as interest rates ramped upwards, and single-family home prices will likely continue to increase as interest rates drop.”