MLSD finances explained during community meeting

MOSES LAKE — Moses Lake School District Interim Superintendent Carol Lewis led the first community meeting of four Tuesday night to address the district’s current financial situation. Lewis explained to 27 attendees the financial errors that occurred which caused MLSD to have a $20 million budget shortfall.

The discussion included: how school finances work, the double levy failure, the loss of local effort assistance, the miscalculation of student body numbers and accounting errors, where funds were spent twice.

School Finances

Lewis began the presentation by breaking down how public school districts are funded.

Federal funds are restricted on how they may be spent and include Title I A, Title I C, Title II, Title III, Title IV, Perkins Career and Technical Education grants, food service and other small specific grants. These funds must be used in an allocated fashion.

State funds have restrictions but are more lenient than federal funds. State funding includes general apportionment based on student body numbers, special education, learning assistance programs, transitional bilingual, highly capable, transportation operations and early childhood.

Local funds are the least restrictive and include levy, local effort assistance, gifts, grants, donations, interest, sales, fines and facility use. These funds must be used within the school district, but they are not mandated to one specific expense. Local funds are around 15% of most school districts’ funding, Lewis explained.

Bonds are also locally funded; however, they must be spent on specific construction or major renovation which voters approve of.

Double Levy Failure: $4,061,313

MLSD tried to pass two levies in the spring of 2024. One on Feb. 13 which didn’t pass with 51% of voters rejecting the levy. The district then put the levy up for a vote again April 23, where 54% of voters rejected the proposition.

“So that was a reduction or a loss of little over $4 million so there's the first $4 million in that $20 million that we keep hearing about and talking about,” Lewis said.

Lewis then explained after the double levy failure, the school district began thinking about how to reduce their spending by what they were not going to have. This is when they began digging into the school finances of previous years.

Local Effort Assistance: $4,232,958

With the double levy failure, MLSD also lost local effort assistance, which are state funds decided by the property value of the entire district, Lewis explained.

“The higher your property value, the less local effort assistance you get,” Lewis said. “The lower your property value, the more local effort assistance you get. That, you only get that though, if the voters pass the levy.”

Without the levy passing, MLSD lost around $4.2 million in local effort assistance.

“That was $8 million, and we would have had to deal with that $8 million loss in our budget this school year, but we had to deal with a lot more,” Lewis said.

Student miscount: $2.1 million

MLSD receives around $10,500 per full-time student enrolled in the district. Students who attend high school for half of the day and college for the other half are not considered full-time students, Lewis said. About 85% of the district's funding comes from this apportionment.

During the summer, the school district budgets are based on how many students the district expects to have. Lewis explained that these estimates are made before students attend the first day of school. Then, Sept. through Dec., the budget is based on the estimate not the actual number of learners.

During the 2022-23 school year, the district overestimated its student body by 207 students. This resulted in the district receiving around $2.1 million in funds for students who were not enrolled. Lewis said those funds had to be paid back to the state.

“It was a mistake. It was a mistake that someone made, and they counted a bunch of kids twice,” Lewis said. “So, what happened was our plan expenditures were way too high. We hired too many teachers. We had too much budget.”

Lewis then explained that the Education Service District reached out to someone in the accounting office and expressed concerns that the enrollment was incorrect.

“The staff who received those concerns blew it off and said, ‘No, we're right, you're wrong,’” Lewis said.

The overestimation resulted in the funding being pulled back this past January.

“That wasn't known to anyone outside the Finance office, and it was probably only known to a couple of people, and none of those people are still employed here in Moses Lake,” Lewis said.

Accounting Errors: $9.9 million

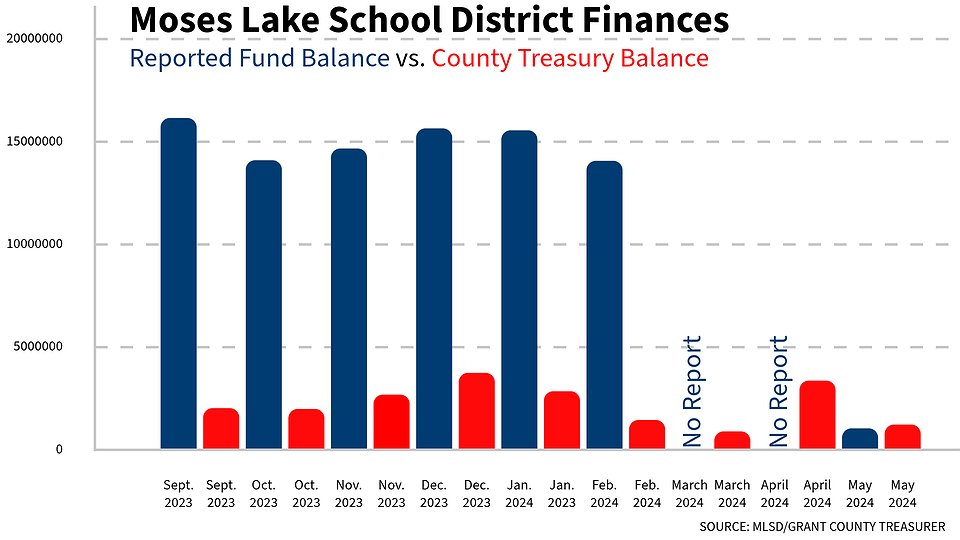

The next part of the presentation, Lewis explained using metaphors of hypothetical financial situations. In the first example, she compared the general fund balance reported to the school board like individual records a household keeps, like a checkbook. Then, the county treasurer's report was like a monthly bank statement. Usually, these records are pretty similar to one another, though not exact depending on the timing of checks clearing.

The MLSD school board and officials were receiving the “checkbook” but not the “monthly bank statements.” For example, in March 2021 the “checkbook” showed the district having $15.3 million and the “monthly bank statement” showed $14.9 million.

However, when you get to February 2024 the “checkbook” shows the district has $14.1 million and the “monthly bank statement” shows $1.4 million.

The second example she gave explains where those funds went.

A person receives $1,000 in income monthly, however, during February this person picks up extra jobs and so they make $3,000 a month. In Jan., the hypothetical person knows they will be getting $3,000 in February so they dip into their savings and make a grand purchase spending $4,000. This is fine because they know the $3,000 check in February is coming. However, February rolls around and the person spends the additional $3,000 check they receive, although they had already spent it in Jan. This person then double-spent because the money was already spent in Jan., it was not available to spend in February.

Lewis said this is what happened at MLSD with accrual accounting. Accrual accounting is a common practice in school districts because funding comes in at random times, therefore the district will dip into a “savings account” to pay for needed things and repay the “savings account” when the funding comes in.

However, the “savings account” was not being repaid when funds came in, instead, those funds were also being spent, like in the example above.

“I know that if somebody was paying attention to this, I do know there's no reference of anyone in our finance office balancing that Treasury report with the fund balance and that's just a common standard practice that should have been happening,” Lewis said. “In May of 2024, when the ESD dug into our financial records, they noticed an additional unconventional approval county gap. It wasn't illegal, it wasn't wrong, but it does seem as though someone was trying to present a better picture than what actually existed.”

Solutions so far

In May 2024 there was a spending freeze.

Then there was a staffing reduction which is saving the district around $1.7 million dollars monthly.

MLSD is now reconciling its general fund balance to the County Treasurer’s reports, both of which will be released to the public now, Lewis said.

The school board is now reviewing accounts payable twice monthly and is receiving a budget status report from the new finance director, Mitch Thompson.

The school board must approve single purchases of more than $25,000 and all expenditures require prior approval from an official.

Thompson has programmed alerts into accounting tools to ensure accruals are properly reversed.

MLSD is also on a zero-based budget, where they are only budgeting for what the district has and accounting for every purchase.

Upcoming meetings

There will be three more community meetings and Lewis said she plans to record a presentation and upload it to the MLSD website.

“I plan to record the presentation in a Screencastify mode and put that out on the website. So, if people can't come to one of these meetings, then they can see it that way,” Lewis said. “It won't be interactive like the meetings are.”

Further meetings are set for Oct. 7 at Endeavor Middle School, Oct. 14 at Vanguard Academy and Oct. 22 at Frontier Middle School. All are from 6 to 7 p.m.

Correction: In the solutions section above, the story had the time period wrong. The $1.7 million is a monthly savings rather than an annual savings.