Listings are up, interest rates may come down

COLUMBIA BASIN — More homes are on the market this month than a year ago, according to data recently released by the Northwest Multiple Listing Service, which tracks real estate trends in 26 of Washington’s 39 counties.

Active listings increased 37.7% in July 2024 compared to July 2023, according to the NMLS. The increase in Grant County was less of a swing; there were 346 active listings in Grant County in July 2024, a 25.8% increase from July 2023. Adams County had 46 active listings in 2024 versus 35 in 2023. The biggest jump in active listings was in Douglas County, where listings rose 80.8% between the Julys.

New listings were also up. Adams County went from 12 new listings in July 2023 to 15 in 2024, and Grant County showed a 34% increase, from 126 to 169. Statewide, the increase in new listings was up 13.1%.

The number of sales that closed was up as well, but not by the same margins. Across Washington, sold homes increased by 5.9%, while in Grant County the figure was 12.5%, from 80 sales to 90. That’s a much larger change than from June 2023 to June 2024, which saw an increase of 4% in Grant County and a decrease of 3.1% statewide. In both cases, June 2023-June 2024 and July 2023-July 2024, Adams County dropped significantly, by more than 50% in June and 73% in July.

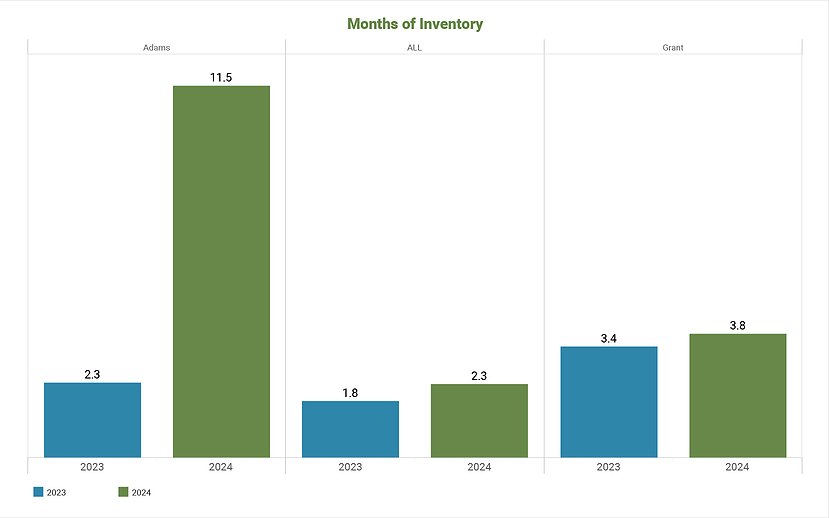

One measure real estate experts use to determine the health of the market is months of inventory, which means the amount of time it would take to sell all the homes on the market at a given time. A balanced market is considered 4-6 months of inventory, according to the NMLS. Grant County had 3.8 months of inventory in July, compared to 2.3 statewide. Again, Adams County was the outlier, with 11.5 months of inventory. In July of 2023, all three figures were at least in the same ballpark: 2.3 months for Adams County, 3.4 for Grant County and 1.8 statewide.

A factor in the sluggish market may be continued high interest rates, according to the NMLS. Thirty-year mortgage interest rates were 6.73% on Aug. 1, the lowest rate since February, but still a far cry from the average 3.94% of five years ago. Rates like that discourage both potential buyers facing high rates and would-be sellers who don’t want to let go of their low-rate mortgages and buy something else at a higher rate. That may change in the near future, however.

“Although the Federal Open Market Committee of the Federal Reserve Bank did not lower rates at its July 31 meeting, it suggested that it might do so in mid-September,” Steven Bourassa, director of the Washington Center for Real Estate Research at the University of Washington, wrote in the NMLS statement. “A weak jobs report, largely reflecting a growing labor force, combined with low inflation suggests that the Fed will indeed lower rates next month with additional rate cuts expected at subsequent meetings.”