Othello expands Multi-Family Tax Exemption area, approves code of conduct

OTHELLO — The Othello City Council met Monday for its regular meeting, during which members approved an expansion of the city’s Multi-Family Tax Exemption program target area, a facility use agreement and fee waiver and the council code of conduct.

Othello Community Development Director Anne Henning presented the tax exemption agenda item.

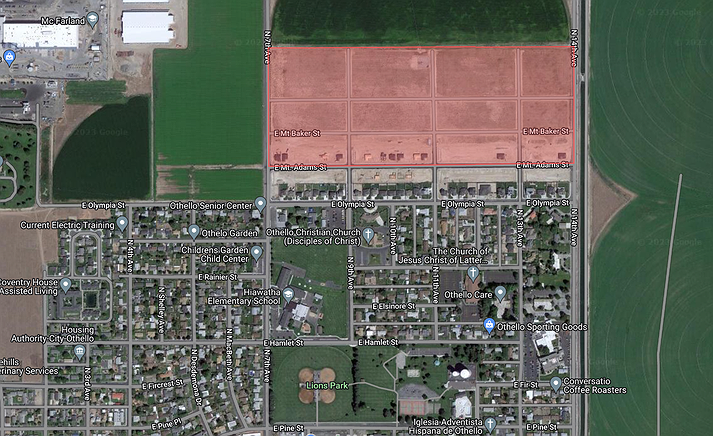

“So the council approved the Multi-Family Tax Exemption program earlier this year, and at the time we did that, we looked at all of the areas in town that would be suitable for this program. At the time the area that's being asked about now was not zoned residential,” Henning said. “But now it's zoned R-4, so it would allow multi-family development.”

Henning said the owners of the property north of Sand Hill Estates asked the city to add the land to the program.

According to the city of Othello website, the MFTE program provides a 12-year property tax exemption if new or ‘“rehabilitated” multi-family housing units meet certain criteria. The website states the purpose is to encourage the building of more housing units in Othello to address the city’s housing shortage.

The website said to qualify, housing units must create at least 4 units of multi-family housing, must be in the prescribed residential target area, the units have to remain as living units all 12 years, at least 20% of the units must be rented or sold to low- and moderate-income households, the property owner must sign a contract with the city and submit annual reports, and the project has to have a density of at least 15 units per acre. The total number of MFTE units is limited to 300.

The agenda memo explained Monday’s addition to the target area and its impact on the city’s revenue.

“Just like in the rest of the MFTE area, if compliant multi-family units are built in the added area, the City and other taxing districts will collect less property tax than if the units were built without the program,” the memo said. “But without the program, the units might not be built at all and would therefore not exist to generate any new property taxes.”

The memo also contained the city staff’s recommendation for action.

“Staff recommends that the Council add this area to Residential Target Area ‘A.’ Staff feels that if the Sand Hill area had been zoned R-4 at the time the initial designations were done, it would have been included at that time,” the memo said.

Council member Angel Garza recused himself from the discussion and the vote.

Everett said during the Oct. 23 council meeting that he was opposed to the Multi-Family Tax Exemption program from the beginning, and therefore did not want to further expand it. He elaborated on his opinion Monday.

“Listen, the (Multi-Family) Tax Exemption, that was a bad program. It never should have been passed, and it doesn't make any sense to expand the area for building. It just doesn’t make any sense to me,” Everett said.

The vote passed, with only Everett opposed.

Parks and Recreation Coordinator Valerie Hernandez presented the facility use agreement for Saturday’s Miracle on Main Street and its associated fees for the Othello Holiday Committee, the organizers of the event.

“The total came out to $1,554. That includes a $464 special event fee, the $580.37 for the additional items added in the packet, and then we have a $510 damage deposit. So, we hope that the council approves the resolution and the facility use agreement,” Hernandez said.

Council member Corey Everett said he thought the city had previously decided to automatically waive the fee for certain annual events such as Miracle on Main Street.

“It's too important of an event, a potential event for the city for bringing people in. I’d like to waive the $464,” Everett said.

After voting to waive the fee, the council also decided to co-sponsor the event.

Also at the meeting, the council unanimously approved a code of conduct for city council members, which guides council member behavior and meeting policies.

Council member John Lallas suggested that there be a separate code of conduct for the mayor’s position in case a future mayor does not also serve as city administrator like current Mayor Shawn Logan. Since the role of city administrator is an employee of the city, Logan is covered by the city’s employee conduct policies.

“I think it needs to be separate because the situation could change to where we don't have what we have today,” Lallas said. “That's at the discretion of the council. So, with any new election coming up, that’s going to have to be considered.”

Gabriel Davis may be reached at gdavis@columbiabasinherald.com. Download the Columbia Basin Herald app on iOS and Android.