Royal City approves 2024 property tax levy

ROYAL CITY — Tuesday’s regular Royal City City Council meeting featured two public hearings on the 2024 budget revenue sources and the 2024 property tax levy, as well as a vote on the levy, which passed unanimously.

Royal City Finance Director Janice Flynn introduced the levy.

“We have the certified levy request amount of $150,000 and an administrative refund amount of $1,555.15. That is based on this year's amount received, $99,442.32, and you can add 1% to that … plus new construction.”

The additional levy amount resulting from new construction is not capped by the regular annual 1% property tax levy increase.

The Municipal Research and Services Center of Washington’s November 2023 Revenue Guide for Washington Cities and Towns explains the administrative refund.

“In some situations, the city may have to refund property taxes paid by individual property owners or cancel property taxes that were due but not yet paid,” said the guide. “A city may choose whether an administrative refund should be included in the following year’s levy, thereby reducing the levy amount received by the amount of the administrative refund, or to levy for the refund.”

Royal City will be levying the refund amount.

“It's a refund to the city, which means it makes the levy a little higher, so we get the money but it's a little more money that the taxpayers have to pay, the property owners…Most of that refund comes from the senior exemptions that the senior citizens who qualify get, so they pay a lesser amount. Basically, that amount goes to the other taxpayers.”

The MRSC Revenue Guide also specifies that the 1% annual increase does not translate directly to a 1% increase for property owners.

“Because the assessed valuations of different properties fluctuate at different rates depending upon market conditions, some property owners may see their property taxes go up much more than 1%, while other property owners may simultaneously see their property tax bills decrease.”

There was no public comment on the 2024 revenue sources or the property tax levy, and there was no public comment on the preliminary budget hearing at the Oct. 19 regular council meeting, according to the meeting minutes.

The Oct. 19 council agenda packet provided Royal City’s 2024 preliminary budget. It lists the city’s total beginning balance at $6.4 million, its projected revenues at $7.6 million, its projected expenses at $8.3 million and its projected balance at the end of 2024 as $5.7 million.

According to the Oct. 19 meeting minutes, Bob Murphy, with the Royal City Golf Course, requested additional funds of $25,000 toward equipment purchases if needed. The council unanimously approved the payment. Also at the previous meeting, a motion was unanimously approved to nominate Ryan Piercy as the Mayor Pro Tem.

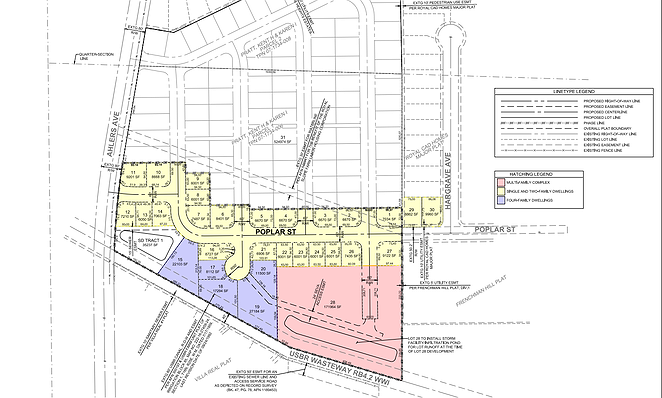

At Tuesday’s meeting, Alex Kovach provided an update on CAD Homes’s preliminary plat submittal for the first phase of the future Pratt Hills residential subdivision. According to the plat submittal, the development will be located on the north side of the canal between the end of Poplar Street and Ahlers Avenue.

Kovach requested that he and CAD Homes be given a little more time to make adjustments to the preliminary before the council votes on it. The council agreed to look at the proposal at one of the next two council meetings.

Gabriel Davis may be reached at gdavis@columbiabasinherald.com.

Royal City City Council members listen to Finance Director Janice Flynn as she explains the city’s 2024 property tax levy.

Royal City City Council members listen to Finance Director Janice Flynn as she explains the city’s 2024 property tax levy.